In today’s digital-first world, peer-to-peer payment platforms like Cash App have revolutionized how we transfer money—but they’ve also attracted sophisticated scammers. As of 2025, awareness of scam types and understanding Cash App’s refund policy is crucial.

🔐 What Makes Cash App a Target for Scammers?

Cash App’s simplicity and instant transaction features make it attractive for users—and unfortunately, for scammers too. With limited buyer protection and no phone-based customer service, it becomes easier for bad actors to exploit unsuspecting users.

⚠️ Common Types of Cash App Scams

Here are the most frequently reported scams Cash App users face in 2025:

1. Accidental Payment / Overpayment Scams

Scammers send you money “by mistake” then ask for a refund to a different account. Once accepted, the original transaction is reversed or flagged as fraudulent—you lose the refunded amount.

2. Cash‐Flipping Scams

Fraudsters promise to “flip” your cash with high returns. Initially, they’ll send a harmless small amount to build trust, then ask for a larger sum—and vanish.

3. Loan Scams

You receive unsolicited offers for loans with low credit requirements—until you’re told to pay “processing fees” via Cash App. The lender disappears post-payment.

4. Fake Customer Support / Phishing

Scammers impersonate Cash App support via email, text, or calls. They ask you to verify personal details or instruct you to send money to “secure your account.” lifelock.norton.com+1blog.incogni.com+1

5. Charity / Disaster Relief Scams

In times of crisis, impostors request donations via Cash App—often cloaked as urgent appeals. Once sent, you won’t hear from them again.

6. Fake Seller / Buyer Scams

- Fake seller: You pay for an item—but never receive it.

- Fake buyer: They pay with stolen card, dispute later—and your account is debited.

7. QR Code Scams

You scan a QR code promising a prize or discount—but it triggers a phishing site or malware download aiming to steal your credentials.

8. Social Engineering (“Friends in Need”)

Scammers impersonate loved ones in urgent situations. “Hey, I’m in trouble—send money via Cash App.” Since the request is plausible, victims often comply.

9. Romance & Pig‑Butchering Scams

Criminals form faux relationships that lead to fake investments or flights needing payment. Often linked to romance or pig‑butchering schemes involving phishing and emotional manipulation.

10. Job Offer & Prize Scams

Fake job offers or prize notifications require an upfront “verification fee.” The work or prize never comes, but your funds disappear.

11. Government & Social Security Scams

Scammers pose as government agents demanding payment for tax issues, Social Security re‑verification, or bail for a jailed family member. expressnews.com

12. Gift‑Card Exchange Scams

They claim to swap your gift cards for Cash App money—but after you send the cards, they vanish.

13. Crypto & Fake Investment Scams

Scammers promise large cryptocurrency returns or stocks (even through Cash App’s investing feature), then disappear after you send money.

Cash App Refund Policy: What It Covers

Cash App’s refund policy isn’t a blanket guarantee—refunds depend on the nature of the transaction. Broadly:

- Voluntary refunds: If you accidentally pay someone, you can send a refund request via the app—but the recipient must approve it.

- Disputed transactions: You can report a payment as “I was scammed” in the app’s Support section. Cash App will investigate and may reverse the charge if fraud is confirmed—though it’s not guaranteed.

- Bank chargebacks: If a scammer used a stolen credit card or linked debit card, you can contact your bank to request a chargeback.

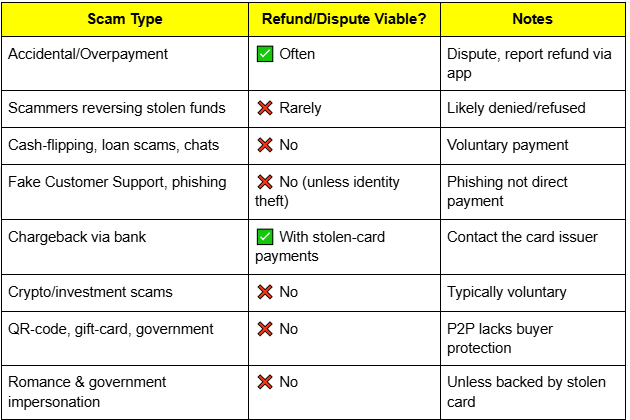

Cash App Refund Policy Breakdown

Let’s see which scenarios may qualify for a refund/dispute:

Refunds are most likely when the scam involves fraud against a stolen or compromised payment method—especially credit/debit card. Cash App refunds voluntary payments or identity theft only under narrow circumstances.

How to Get a Refund in Case of Scam

- Act immediately—time is critical.

- In-app Support:

- Open Activity, select questionable transaction.

- Tap “…” → Report an Issue → choose I was scammed.

- Open Activity, select questionable transaction.

- Send refund request if it was your mistake:

- “…” → Refund → OK. Recipient must approve.

- Dispute fraudulent charges:

- “…” → Cash App Support → Dispute this transaction for unauthorized payment.

- Contact bank/card issuer if payment via stolen credit/debit.

- Report to authorities:

- File with FTC.

- Notify local police.

- Provide documentation: transaction details, $cashtags, screenshots.

- File with FTC.

How to Prevent Cash App Scams

- Only send money to known people using verified $cashtags.

- Never refund someone through external accounts—use only Cash App’s in-app refund.

- Ignore phishing attempts—Cash App will never ask for PIN, social or password via messages.

- Enable security features:

- PIN code and/or biometric lock

- Two‑Factor Authentication (SMS/email)

- Encryption (already built-in)

- Activity alerts

- PIN code and/or biometric lock

- Check transactions regularly in the Activity tab.

- Avoid public Wi‑Fi for financial transactions.

- Be skeptical of too-good-to-be-true offers—like cash‑flipping or prizes.

- Verify urgent requests via alternate channels—call your friend/family to confirm emergencies.

- Guard personal details—never share passwords, PINs, card data.

Use official app only—no links from email or messages outside the app.

Conclusion

Understanding the types of Cash App scams and how they relate to the refund policy is your first line of defense in 2025. With digital fraud becoming more sophisticated every year, users must stay informed and vigilant. While Cash App provides limited protection and refunds for certain types of unauthorized transactions, most scams—especially those involving voluntary payments—are not covered.

That’s why it’s essential to recognize the red flags early, avoid interacting with suspicious links or fake profiles, and always verify who you’re sending money to. If you ever suspect that you’ve fallen victim to a scam, take immediate action: cancel the transaction if possible, report the user through the app, and contact your bank if necessary.

Need Assistance? Don’t hesitate to get in touch:

- 📱 Call: +1(771) 210-4102

- ✉️ Email (FTC/CFPB): Use their websites

- 📞 Contact your bank immediately if cards are involved

- 🛡️ Use official channels only

Stay smart—and safe—with your Cash App transactions in 2025!